Alternative Investment Funds (AIFs) in GIFT City IFSCA.

- GIFT CFO

- Jan 3

- 6 min read

Updated: Sep 16

The IFSCA Official aiming to create a globally competitive and streamlined regulatory framework for investment funds, established an Expert Committee on Investment Funds to chart the future course for the funds industry in International Financial Services Centres (IFSCs). The Committee Report, submitted on January 31, 2022, has culminated in the introduction of the IFSCA (Fund Management) Regulations, 2022.

Fund Management Evolution

A significant shift in regulatory oversight now places emphasis on regulating Fund Managers rather than the funds themselves. Fund Managers must obtain registration from IFSCA, with fund launching requirements tailored to specific investor classes. The new regulations introduce three categories of Fund Management Entities (FMEs) with varying degrees of oversight:

Authorised FME: Targets accredited investors or those investing above USD 250,000, focusing on start-ups and early-stage ventures through Venture Capital Schemes, with a minimum net worth of USD 75,000.

Registered FME (Non-Retail): Engages accredited investors with a capital commitment above USD 150,000, offering services like portfolio management and private placements of REITs and InvITs, requiring a minimum net worth of USD 500,000.

Registered FME (Retail): Open to all investors, including retail, facilitating public offers of Investment Trusts and ETFs, demanding a minimum net worth of USD 1,000,000.

Scheme Categories

The Regulations classify schemes into Venture Capital Schemes, Restricted Schemes, and Retail Schemes. These classifications dictate the investor base, offer mechanisms, and regulatory requirements, ensuring tailored approaches for different types of investments and investors.

Key Attributes of FMEs

FMEs Skin in the Game:

• Contribution requirements to be fulfilled by FME or its associates within 45 days, unless exempted and to be maintained on ongoing basis

• The contribution requirements by the FME is not mandatory in following cases:

- In case of VC schemes and Restricted schemes (Non-retail):

o At least 2/3rd of the investors in the scheme by value permit waiver of such contribution;

o At least 2/3rd of the investors in the scheme are accredited investors; or

o FOF scheme investing in a scheme which has similar such requirements (applicable in case of Retail schemes)

In case of relocation of funds/schemes established or incorporated or registered outside India to IFSC

Key Attributes of Schemes

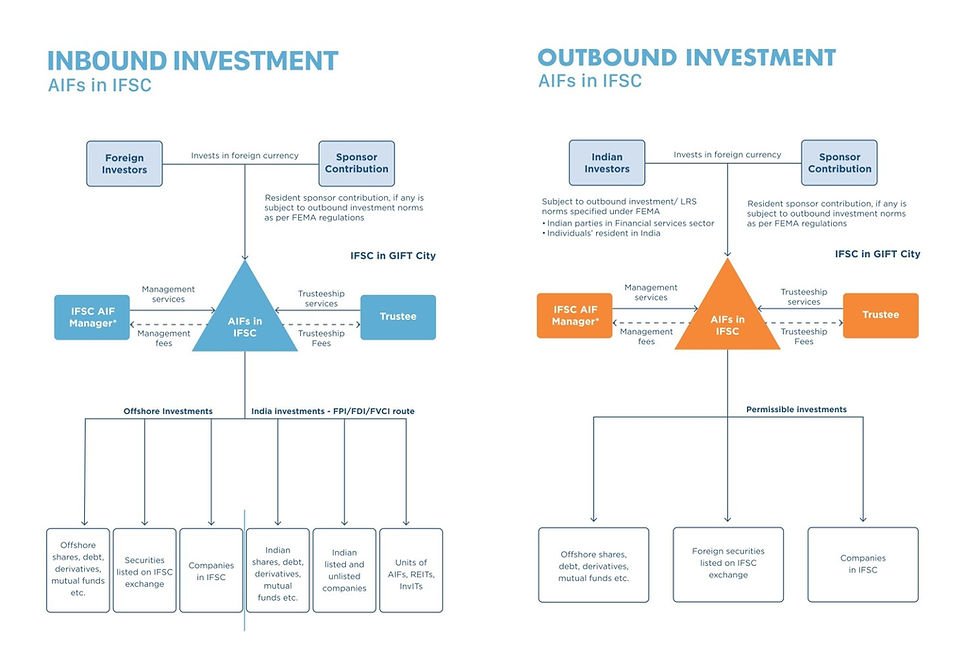

Permissible Activities of Funds

Tax Benefits for AIF in gift City

For AIFs and its investors

I. Category I and II AIF

Category I and Category II AIF have tax pass-through status for Indian income-tax purposes (except for business income, which is taxable in the hands of the AIF for which 100% tax holiday can be claimed for a period of 10 consecutive years out of a block of first 15 years).

Investors are taxed on income arising from investments made by the AIF as if the investments were made directly by them.

Income accruing or arising or received by non-resident investors from offshoreinvestments through a Category I and II AIF is not taxable in India.

Investors can claim losses (other than business loss) of AIF on pass through basis, provided the units of such AIF are held for a period of 12 months or more. However, any business loss can be carried forward only at the AIFlevel.

Exemption has been provided to non-resident investors from filing return of income, provided they earn income only from investments made in a Category I or Category II AIFs in IFSC and tax has been deducted on the distribution made by such AIFs to non-resident investors. Further, such non-resident investors are also exempted from obtaining PAN in India.

To the extent beneficial, the investors can avail the tax treatment in accordance with the Tax-treaty, subject to satisfaction of Tax-treaty eligibility conditions.

II. Category III AIF

Category III AIFs are subject to fund level taxation.

The following income earned by the Category III AIF, which are attributable to non-resident investors in the AIF, is exempt from tax:

Income on transfer of any securities (other than shares in a company resident in India), including derivatives, debt securities and offshore securities.

Income from securities issued by a non-resident (not being a Permanent Establishment) and where such income otherwise does not accrue or arise in India

Income from a securitisation trust chargeable under the head “profits and gains of business or profession

Income on transfer of specified securities listed on a recognised stock exchange located in IFSC where consideration for such transaction is in convertible foreign exchange

Income on transfer of shares in an Indian company is taxable as follows to the Category III AIF:

o Short-term Capital Gains - 15% if Securities Transaction Tax paid, else 30%;

o Long-term Capital Gains - 10%

Income in respect of securities (such as interest, dividend) is taxable to the Category III AIF at the rate of 10% (5% in case of interest income on certain rupee denominated bonds, Government securities or municipal debt securities referred to in section 194LD).

Any income accruing or arising to or received from the Category III AIF or on transfer of its units is exempt from tax in the hands of investors.

Surcharge on certain Long-term Capital Gains, Short-term Capital Gains and dividends earned by the Category III AIF is capped at 15%. Further, the provisions of Alternate Minimum Tax are not applicable to the Category III AIF.

Exemption has been provided to non-resident investors of Category III AIF in IFSC from obtaining a PAN and filing income-tax return in India

Exemption from stamp duty, Securities Transaction Tax & Commodities Transaction Tax for transactions carried out on IFSC exchanges.

For Manager:

• 100% corporate tax exemption for 10 consecutive years out of block of 15 years (from date of approval from regulator) in respect of income from business carried on in IFSC.

• The Minimum Alternate Tax (‘MAT’)/ Alternate Minimum Tax (‘AMT’) rate has been reduced to 9% (as against 18.5%). However, companies in IFSC choosing to opt for new tax regime under domestic tax law shall be exempt from MAT provisions.

• The dividend distributed by Manager may be taxable in the hands of its shareholders under the domestic tax law.

• Supply of services by Manager to AIFs in IFSC is exempt from Goods and Services Tax. The same shall be applicable to services by FME to Scheme in IFSC.

• Interest payable to a non-resident in respect of monies borrowed exempt from income tax.

Attribution mechanism

The CBDT has notified rules prescribing the method of computation of income of the Category III AIF in IFSC attributable to units held by non-resident investors.

The key aspects of the attribution mechanism are as follows:

• The attribution mechanism is based on the Assets Under Management (AUM) of the AIF.

• Income arising from transfer of security is attributable on the basis of the average of daily aggregate AUM of the AIF over the period of holding of the security. Income received in respect of securities is attributable on the basis of the AUM as on the date of receipt of income.

• The term ‘AUM’ has been defined as the closing balance of the value of assets or investments of the AIF as on a particular date.

Relocation of Offshore funds to the IFSC:

Tax neutrality provided for relocation of Offshore funds to IFSC:

The Finance Act, 2021 introduced provisions to provide for tax neutrality in case of relocation of offshore fund or wholly owned Special Purpose Vehicles of the Offshore fund to the resultant fund (Category I/ II / III) in the IFSC, where the transfer of assets have been taken place on or before March 31, 2023 as follows:

Exemption from capital gains from any transfer, in relocation, of a capital asset of the original fund or its wholly owned Special Purpose Vehicles of the original fund to the resultant fund in the IFSC.

Exemption from capital gains from transfer by a shareholder / unit holder, in a relocation, of capital asset being share / unit held by him in the original fund; or the original fund itself, in consideration for share / unit in the resultant fund.

Exemption from capital gains tax arising or received by a non-resident investor or a Category III AIF in IFSC, on account of transfer of shares of an Indian company by the resultant fund or the Category III AIF to the extent attributable to the units held by non-resident and such shares were transferred from the original fund, or from its wholly owned special purpose vehicle, to the resultant fund pursuant to relocation and where the capital gains on such transfer would originally not been subject to tax had the relocation not taken place.

Cost of acquisition to previous owner shall be available to the resultant fund.

No impact on carry forward of losses with change in the shareholding of Indian company to the extent the change in shareholding has taken place on account of relocation.

Regulatory Relaxations

One time “Off-market transfer” of securities permitted by SEBI for offshore funds relocating to IFSC

Continuing interest requirement for Manager / sponsor has been made voluntary for Resultant Fund

Disclaimer: The information provided in this post is for general informational purposes only. It is not intended as professional advice or to replace consultation with qualified professionals. While we strive to ensure the accuracy and reliability of the information presented, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the content contained herein. Any reliance you place on such information is therefore strictly at your own risk. We disclaim any liability for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this post. Always seek the advice of professionals or relevant authorities regarding your specific situation or circumstances.

Comments